Irmaa 2025 Brackets And Premiums Chart Of Accounts - Irmaa Brackets 2025 2025 Erinn Emmaline, Here is how you can learn about the change and how to avoid irmaa. To determine whether you are subject to irmaa charges,. Here is how you can learn about the change and how to avoid irmaa. That full table is presented next.

Irmaa Brackets 2025 2025 Erinn Emmaline, Here is how you can learn about the change and how to avoid irmaa. To determine whether you are subject to irmaa charges,.

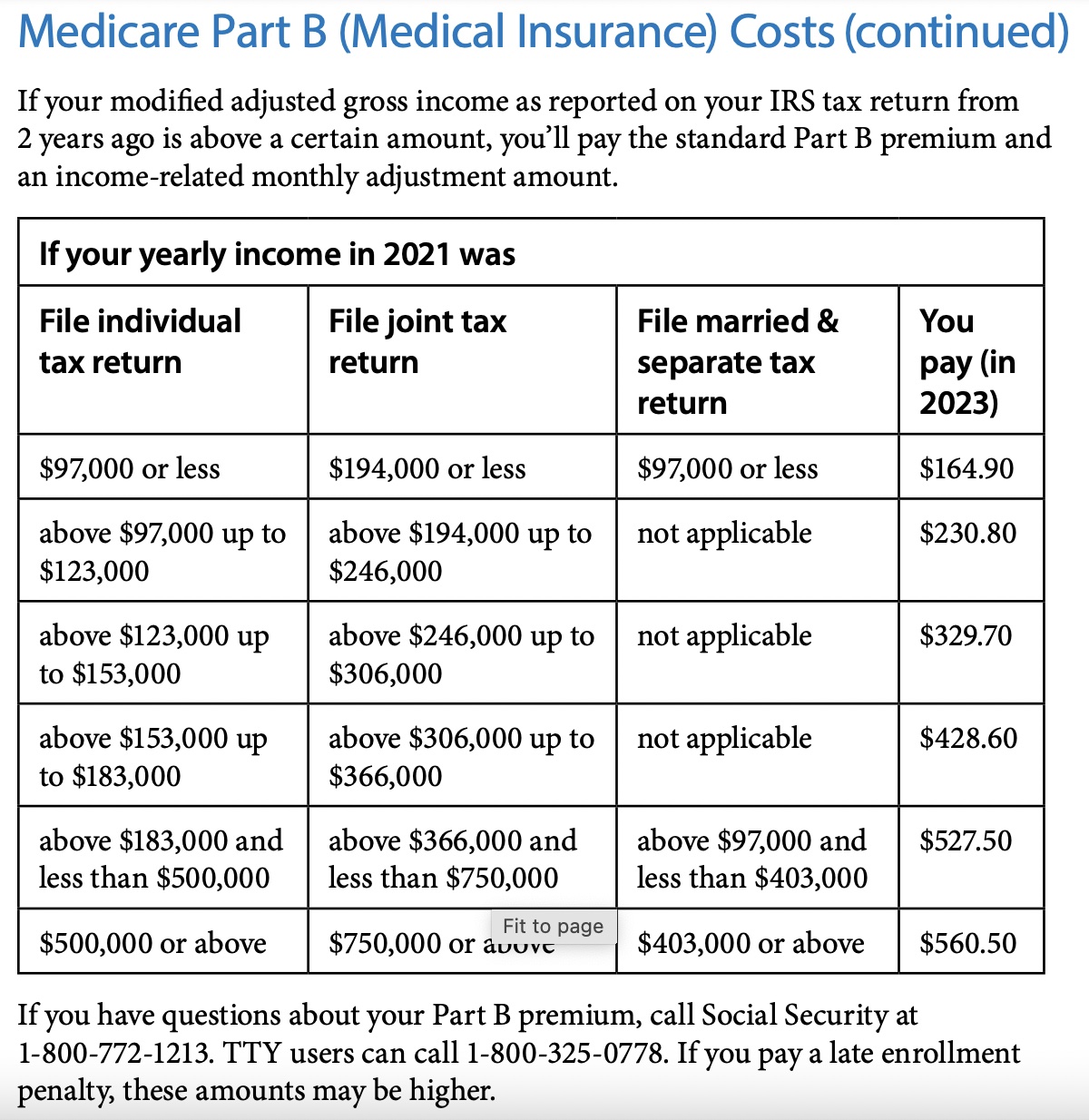

Irmaa 2025 Table Chart Lorne Rebecka, The irmaa is calculated on a sliding scale with five income brackets, topping out at $500,000 and $750,000 for individual and joint filing, respectively. Medicare irmaa 2025 brackets and premiums tani quentin, see the chart below, modified adjusted gross income (magi), for an idea of what you can expect to pay.

IRMAAmedicarepremiumchart ClearHealthCosts, On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and. That full table is presented next.

Irmaa 2025 Brackets And Premiums Chart Of Accounts. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and. Irmaa is a surcharge added to your medicare parts b and d premiums, based on income.

Irmaa is a surcharge added to your medicare parts b and d premiums, based on income.

2025 Irmaa Brackets For Medicare Premiums Dallas Shelia, This blog post will help you better understand the medicare 2025irmaa brackets, its impact on medicare premiums, and the role of magi (modified adjusted. Here is how you can learn about the change and how to avoid irmaa.

Here is how you can learn about the change and how to avoid irmaa.

Irmaa 2025 Table Chart Lorne Rebecka, Learn more about irmaa for 2025 and how it impacts your medicare costs. Here are the irmaa income brackets for 2022 2025, and.

This blog post will help you better understand the medicare 2025irmaa brackets, its impact on medicare premiums, and the role of magi (modified adjusted.

Irmaa Tables For 2025 Maura Nannie, To determine whether you are subject to irmaa charges,. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and.

The 2025 IRMAA Brackets Social Security Intelligence, This figure combines your adjusted gross income (agi) and any non. Magi plays a critical role in determining where you fall within the 2025 irmaa brackets.

The IRMAA Brackets for 2025 Social Security Genius, Irmaa is a tax on your income through medicare part b and part d coverage if you have too much income while in retirement. The irmaa is calculated on a sliding scale with five income brackets, topping out at $500,000 and $750,000 for individual and joint filing, respectively.

What IRMAA bracket estimate are you using for 2025? (2025), Medicare irmaa 2025 brackets and premiums tani quentin, see the chart below, modified adjusted gross income (magi), for an idea of what you can expect to pay. Learn more about irmaa for 2025 and how it impacts your medicare costs.

The irmaa is calculated on a sliding scale with five income brackets, topping out at $500,000 and $750,000 for individual and joint filing, respectively.

The IRMAA Brackets for 2025 Social Security Genius, The irmaa is calculated on a sliding scale with five income brackets topping out at $500,000 and. You pay higher medicare part b and part d premiums if your income exceeds certain thresholds.